T H E B L O G

Will Foreclosures Be Flooding the Market Soon?

With the rapid shift that’s happened in the housing market this year, many people are worried that we’re headed for a repeat of the crash we saw in 2008. There are, however, many big differences between what’s happening today and what happened during the bubble in the early 2000s. The main reason is

Read MoreTips for Buying a Home During the Holiday Season

From traveling to gathering with family to hosting friends at a new home for the very first time, the holiday season can be a whirlwind. But the schedule of celebrations can be even more complicated for someone planning to search for a home this time of year. Here are some tips to make th

Read More-

Is your linen closet bulding at the seams? For many fpeople, linen closets turn into catch-all spots for much more than just sheets and towels - paper products, extra toiletries and other household supplies come to mind. So how can you clean things up? Here are five tips to get you started on making

Read More -

Transform Your Kitchen on a Budget Your kitchen isn't just a place to cook, It's where family and friends tend to gather. It still needs to serve its intended functions, which means it needs to be designed in the best way possible for you to cook, serve and provide storage. Total kitchen renovations

Read More Should You Sell Your Home in the Winter?

As you thinking about making a move and wondering if winter is a good or bad time to sell? If your current living situation no longer meets your needs (or wants), and if you want to remedy that soon, then give some serious thought to moving during the winter! Here are three reasons you may want to

Read More-

This article from Realtor.com takes a look at the major causes of house fires and how to prevent them. Deadly house fires are growing in frequency—and many homeowners have less time to get to safety. Newer homes and furnishings are burning faster, research shows, giving owners just three to four min

Read More -

Are you thinking of buying a home but don't know what to budget for it? Or how to save money for the purchase? To be able to properly budget, you'll need to understand some of the costs you might encounter. Here are some costs you can expect. Down Payment Saving for your down payment is probably

Read More Tips for Buying a Great Vacation Rental Property

Should You Buy a Vacation Rental Property? A second home or vacation rental is often a dream of many people. But is a vacation rental a sound investment? It can be the foundation for wonderful memories for you and your family, but you may also be thinking about the possibility of renting it out to m

Read MoreIs Retirement a Good Time to Buy a Smaller Home?

Retirement is one of the biggest life changes many people face. Retirement can have a major impact on what you need from your home, and if you're planning to do more of the things you enjoy, like traveling, visiting with loved ones, or taking on new hobbies, you may want to focus less on your home

Read MoreCan You Spot Problems With Your Roof?

You don't have to live in a hurricane prone area to get roof damage. Your roof is one of the most important parts of your home, so it's important to keep it in good shape. Roofs are susceptible to a number of problems, which is why it's important to know how to spot them. Here are four common roofi

Read MoreWhat Is A VA Loan? And What Are Its Benefits?

What are the Benefits of a VA Loan? Believe it or not, buying a home doesn’t always require a traditional 20% down payment. If you’re a current or former member of the U.S. Military, you may qualify for a VA loan, which allows you to purchase a home without a down payment. That’s just one of the adv

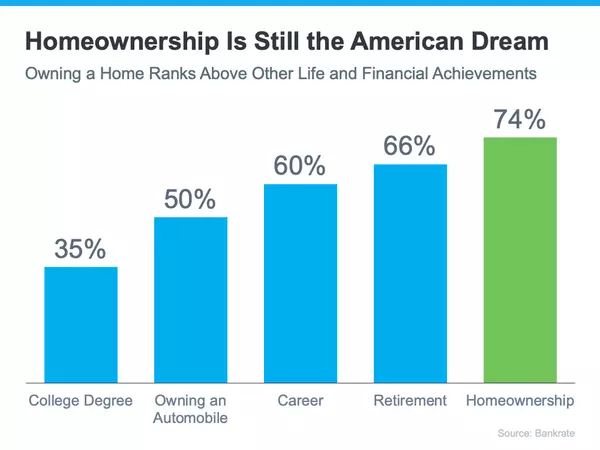

Read MoreBenefits of Home Ownership in Any Market Condition

There's more to consider than just mortgage interest rates when you decide to purchase a home. What else? Well, consider the non-financial reasons it may make sense to make a move. When you add the financial and non-financial reasons together, you just can't beat being a homeowner! Homeowners Can Ma

Read MoreWhat Factors Determine Your Mortgage Interest Rate?

Are you looking for a home, or thinking about jumping into the home-buying pool? If so, you probably want to secure the lowest interest rate possible for your home loan, and that may seem confusing! Especially with the dramatic rise in interest rates that has followed record-low rates. To get the be

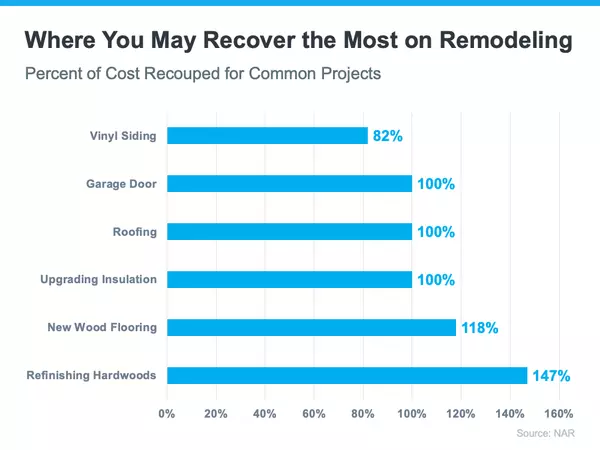

Read MoreShould You Remodel or Renovate Before Selling?

What You Need to Know About Your Local Market Today's real estate market is shifting quickly, so if you're thinking of doing any renovation or remodeling projects for your Andover home before listing it on the market, be sure you're going to get your investment back. These are just some things we wi

Read More-

Like so many people these days, are you working from home? Of have you been working from home for a while, and thinking you need to give your office a bit of a makeover? Try these ideas for making your home office more attractive and comfortable, and to help boost your productivity. Organize, Organi

Read More Should You Buy a Home This Year?

Should I Buy a Home This Year? Today’s cooling housing market, the rise in mortgage rates, and mounting economic concerns have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to factor the long-term benefits

Read More-

Today's housing market is different than it was just a few months - or even a few weeks - ago. So you need to work with your agent to create a plan to get your home sold in the least amount of time and with the least amount of hassle. Start with preparing your home before it hits the market. Price

Read More -

Hidden Kitchen Storage Ideas Is your kitchen small? Or does it feel small because you lack storage space? A small kitchen can be hard to work with, especially when you don't have room for all your essentials, let alone items you want to add to your kitchen just to spruce it up. If you want to add st

Read More -

While some people dream of hardwood or tile flooring, sometimes carpet is the better choice! The process of choosing new carpet isn't as easy as pointing to a sample and knowing "it's the one." There are so many options to choose from, and it can be hard to know which carpet type is best for you. D

Read More Mortgage Pre-Approval. Don't Go Home Shopping Without One!

What is a mortgage pre-approval? It is provided by a licensed lender. The lender will ask you for information about your income, debt, assets and employment. Using that information, along with information about your credit history from the 3 major credit bureaus - Equifax, TransUnion and Experian

Read More

Categories

Recent Posts