T H E B L O G

Preparing Your Home for Cooler Weather

Fall is officially here, have you thought about fall home maintenance? There are some things you should definitely do to be sure your home is ready for the coming change in weather. Drain garden hoses and store them inside to protect them from cracking. Turn off outdoor spigots and make sure exterior pipes, such as lawn irrigation pipes, are drained of water. Cold weather can cause pipes to freeze and burst, creating all sorts of damage to your home. Check your gutters. Be sure gutters are clear of leaves, sticks and other debris. Consider installing gutter caps or screens to help keep the gutters clear. Check the joints between the gutters and downspouts and between sections of the gutters and repair if necessary. Make sure any gaps around doors, window frames, or places where wiring or pipes enter your house are sealed to prevent any water from penetrating and causing mold or structural damage. Seals will also help keep heat in, and unwanted visitors like mice and insects out. Take a peek at your peak – your roof, that is! Get some binoculars and check your roof for missing or damaged shingles. Make repairs before winter wind, ice and snow have a chance to cause damage to your home. Have a professional inspect any wood burning fireplaces or wood stoves, to be sure there isn’t creosote buildup that can cause a chimney fire. Have gas fireplaces inspected for proper venting and to check for broken glass doors. Have your furnace inspected to be sure it’s in optimal working condition for the cold months to come. A little bit of effort will help eliminate potential problems and protect your most valuable asset!

Read MoreWhat Type of Paint Should You Use?

Are you thinking about updating your home by painting? There are a few things you should consider before taking brush to wall! Many companies now offer the same color paint in six different sheens, each reflecting a different amount of light. Paint durability has also been improved in recent years, so you have more sheen options for different walls. Here’s a quick check list for paint finishes. Flat: Flat paint hides imperfections and is good for ceilings. It has a sheen of 0-3% Matte: Matte paint is good for dining rooms and bedrooms, and is good to use with accent walls in a different sheen. It has a sheen of 3-10% Eggshell: Eggshell is durable and washable and has traditionally been used in places where there is high traffic or little fingers that like to touch walls! It has a sheen of 10-25% Satin: Satin has a pearl-like look and has a higher resistance to moisture. It’s good for kitchens and bathrooms and has a sheen of 25-35%. Semi-gloss: Semi-gloss is good for rooms with few windows as its higher sheen helps reflect more light. It’s good for trim, cabinets and doors. Avoid it in rooms that are really sunny. It has a sheen of 35060%. High Gloss: High gloss is the hardest to work with as it is unforgiving of surface flaws, so walls have to be perfectly smooth. Like semi-gloss, it is good for darker rooms. It has a sheen above 85%.

Read MoreIt's In Your Best Interest To Use A Realtor

If you're thinking of buying or selling a home, you'll want to have the most up-to-date information about current market conditions and factors that are influencing it. The best way to make sure you get the most detailed and correct information is to work with an expert - an experienced local Realtor. A Realtor's job is to give you the best advice possible on market trends as well as the ins and outs of the home buying and home selling process. A Trusted Professional It's always a wise idea to seek advice from people who are experts in their field. Professionals have the knowledge and experience to be able to provide you with the best advice for your situation. They will discuss the most effective strategies based on their experience and create a marketing plan that works best for your situation. They’ll continue to use their knowledge to work with you to adjust as new information becomes available. They’ll use that knowledge to explain both the national headlines and what’s happening in your local area. That way, you can feel confident in your decision to buy or sell. With their expertise, a Realtor can anticipate what could happen next and work with you to put together a solid plan. Your Realtor will guide you through the process, helping you make decisions along the way, so you can feel confident in your decision. So be sure to contact us at The Carroll Group when you're thinking of making a move!

Read MoreDebt-to-Income Ratios - What Are They?

When your mortgage lender talks about your debt-to-income ratio (DTI), just what does that mean? Your DTI impacts your ability to qualify for a mortgage. So knowing your DTI even before you apply for a mortgage can help you best move forward into home ownership. What is debt-to-income ratio? Your DTI compares the amount of money you spend each month paying off your debts to your monthly gross income. It gives the lenders an idea of how much money you have to put toward your mortgage and what kind of debt you can handle. Lenders want to be sure you can make your monthly house payment, whatever it might be. Lenders typically look for DTIs lower than 30 percent, though that number and possible exceptions differ from case to case. Higher percentages signal to lenders that your finances are stretched too thin and that you’ll potentially struggle to make your monthly mortgage payments. Back-end and front-end DTI There are two types of DTI: back and front end. Front-end DTI is entirely focused on housing related expenses. It’s calculated by adding your future monthly mortgage payment with mortgage insurance, property taxes, and HOA fees if applicable. That number is then divided by your gross monthly income. Back-end DTI is the percentage of your monthly gross income that goes toward all additional debts. These include things such as student loans, credit card debt, car loans, back taxes, alimony, child support and personal loans. How to calculate your DTI To calculate your DTI, add up all your recurring monthly debt payments. This includes mortgage (if you currently have one), HOA fees, car loan, student loans, child support, alimony, credit card payments and any other personal loans. Once you’ve totaled all these expenses, divide that number by your gross monthly income, which is your pre-taxed income. Multiply that number by 100 to get your DTI percentage. Bottom line You can improve your DTI by paying off your existing debts or decreasing your monthly housing expenses. Reducing your DTI can help you qualify for a better mortgage rate.

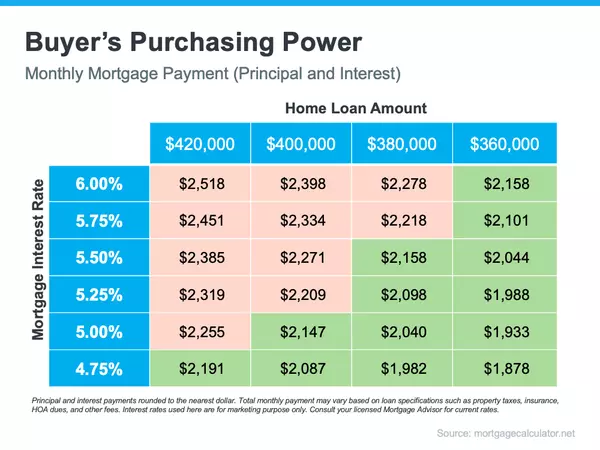

Read MoreHow Mortgage Rates Impact Home Buying Power

Recent housing market data shows the supply of homes for sale is increasing, giving buyers additional options in a market that's been tight for the past two years. So it just may be the perfect time for you to start looking for a home. But it’s important to keep in mind that while inventory is improving, it’s still a sellers' market, so you need to be prepared as you set out on your home search. Here are three tips for buying the home of your dreams today. 1. Understand How Mortgage Rates Impact Your Homebuying Power Mortgage rates have increased significantly this year, and over the past few weeks, they’ve been fluctuating quite a bit. It’s important to stay up to date on what’s happening with rates and understand how they can impact your purchasing power when you’re thinking of buying a home. Even a small change in mortgage rates can have a big impact on your monthly payments. If rates rise, you could exceed your budget unless you pursue a lower home loan amount. If rates fall, your purchasing power may increase, which could give you additional options for your search. 2. Be Open to Exploring Different Options During Your Search The supply of homes for sale is improving, giving you more homes to choose from. But historically, supply is still low. That means as you search for homes, if you still don’t find something that meets your needs, it may be worth expanding your search. A recent Washington Post article highlights a few things buyers can consider today. It encourages opening yourself up to more areas. For example, if there’s a location you’ve previously ruled out (like a particular town, for example) it may be worth taking another look. Also widening your search criteria up to include other housing types, like newly built homes, condominiums, or townhomes can further increase your pool of options. Casting a wider net during your search could help you find a hidden gem. 3. Work with a Local Real Estate Professional for Expert Guidance Ultimately, you need to be prepared when you set out to buy a home. Jeff Ostrowski, Senior Mortgage Reporter for Bankrate, says: “Taking the leap to homeownership can provide a feeling of pride while boosting your long-term financial outlook, if you go in well-prepared and with your eyes open.” No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a local real estate professional to help you understand your local market, search for available homes and be an expert advisor and negotiator to help your offer stand out above the rest.

Read More5 Reasons To Be Thankful For Your Realtor

Real estate agents can help you navigate a complex process. They can save you stress. Real estate agents around the world wake up each day committed to helping their clients navigate some of life’s biggest changes, like upgrading a home when their family grows, downsizing when they become empty nesters, achieving the dream of homeownership by becoming first-time homebuyers – and so much more. Here are five reasons you can be thankful for the relationship you have with your real estate agent. 1. They can help make a home sale relatively hassle-free Who better to trust for such a pivotal transaction than a real estate professional who has been perfecting their craft for years? According to the 2021 RE/MAX Future of Real Estate Report, 58% of survey respondents in the U.S. and Canada identified an agent’s years of experience as something that will become more important to them in the next two years. Of note, according to recent data, RE/MAX agents average 11 years of experience in real estate. RE/MAX also leads the industry in professional designations. Prioritizing ongoing education, RE/MAX agents add to their expertise in order to best serve their clients and to keep their skills sharp. 2. They can help market your home to receive top offers Not only does a qualified real estate professional know how to price and market a home for what it’s worth, they also help avoid pricey hiccups along the way and have relationships with mortgage professionals and other trusted resources for financial and legal needs. Having a home presented by an agent means professional marketing materials, high quality listing photos, and sometimes even help with staging to ensure great first impressions from prospective buyers. These factors help secure top dollar value for sellers. And for buyers, agents use their trained eyes to negotiate and help their clients lock down a fair deal. 3. They are trusted Moving often means big life changes are underway. Agents support their clients through difficult times, emotional moments, or even just navigating complexities like new construction processes or bidding wars. Focused on the consumer’s best interest, RE/MAX agents are easily accessible and prioritize communication. According to shoppers, RE/MAX is the brand with the #1 Most Trusted Agents in the U.S.* and Canada**. 4. They’re caring neighbors The real estate profession is one that builds community. RE/MAX agents, however, go above and beyond to also support the communities in which they live and work, getting involved with local charities, animal shelters, and food banks, and hold leadership positions with local government or real estate organizations. 5. They’re thankful for you! Where would a great agent be without their loyal and trusting clients? RE/MAX agents are grateful for the opportunity each and every day to serve individuals and families, helping make longtime dreams of homeownership a reality. It’s the wonderful people they work with that keep agents committed to their profession year after year. *Voted most trusted Real Estate Agency brand by American shoppers based on the 2022 BrandSpark® American Trust Study. **Voted Most Trusted Real Estate Agency brand by Canadian shoppers based on the 2022 BrandSpark® Canadian Trust Study.

Read More-

Use blinds, vegetation, and solar screens to deflect the sun's glare to keep your home cool. Install window fans to draw cool air into your home at night and provide air circulation during the day. Set ceiling fans in a counterclockwise direction to send cool air down to the floor. Seal air leaks around windows and doors to keep cooler air in. Use a programmable thermostat to adjust the temperature in your home when you’re away.

Read More -

You don't have to invest in top-of-the-line appliances and accessories to cook like a pro. A chef's kitchen takes everything into account to ensure that you have a professional experience at home. Here are some ideas for creating the perfect kitchen in your home. Plan an efficient layout If you've ever seen a commercial kitchen, you know that everything is set up to make it efficient. Use the triangle method to make sure your stove, refrigerator and sink are easily accessible while cooking. This will not only save you steps, but will allow for safer transport of ingredients and pots and pans. Choose durable surfaces The last thing you should be worried about while cooking is damaging your counters. Choose surface materials that won't stain or scratch. Many professional kitchens use stainless steel, but any durable surface will work at home. For a more interesting and warm feeling, think about using granite or quartzite, both of which are super durable and with proper sealing, will be immune to stains. Install a large kitchen sink If you can splurge on only one thing in your new kitchen, make that your sink. The bigger the sink, the easier it will be to do all your prep and clean up after. Choose a single vessel sink rather than having it split into two sections, so you can fit your pots and pans fully into the sink. Who wants to try scrubbing half a pan at a time? A deep farmhouse sink will also make cleanup easier, and you can find a farm sink in stainless steel, various ceramic colors, copper and cast iron. Invest in the best appliances for your budget Not everyone is able to afford to buy restaurant-grade ovens or cooktops, but don't cut corners either. Review your budget and invest in the best appliances you can afford. You'll be able to enjoy them for years. Make lighting a priority Many people believe that lighting is an afterthought, but it should be a priority. Having a well-lit workspace will make it much easier to use your kitchen. If you're starting from scratch, make lighting your first decision.

Read More -

As home prices continue to rise, are you wondering if it makes more sense to rent or own your own home? Well, it's not just home prices that have risen in recent years. Rental prices have significantly risen as well. According to recent studies, the median rent across the country's largest metropolitan areas has increased for 16 consecutive months. Here ae some reasons why buying a home may make more sense for you than renting. You Need More Space Latest study data shows that if you need more space, it may be cheaper to buy a house than to rent a larger apartment or house. With the median rental price of a 2 bedroom apartment nationwide at $2,104 per month, you just may be able to get into your own home for the same price or less - especially when you take into consideration the tax interest deduction and other savings that homeowners can realize. Stability and Wealth Buliding In addition to being more affordable depending on how much space you need, buying has two other key benefits: payment stability and equity. When you buy a home you can lock in your monthly payment with a fixed-rate mortgage. That’s especially important in today’s inflationary economy, where prices prices rise across the board for things like gas, groceries, and more. Locking in your housing payment, which is likely your largest monthly expense, can provide greater long-term stability and help shield you from those rising expenses moving forward. Renting doesn’t provide that same predictability, as your landlord can raise prices as much as the market will bear - or as much as the landlord wants! Buying a home also provides you the chance to build equity, which in turn grows your net worth. That can also improve your credit rating, resulting in lower borrowing costs for other items. As you pay down your home loan over time and as home values continue to appreciate, so does your equity. That equity can make it easier to afford another home in the future if you decide you need a bigger home, smaller home or want to purchase an investment or vacation home later on. When you rent, you aren't investing in your financial future the same way you are when you're paying off a mortgage. You're helping your landlord reap the benefits instead!

Read More -

Did you know that if you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. Based on recent home price appreciation, you’re building equity far faster than you may expect. Here's how: Because there’s an ongoing imbalance between the number of homes available for sale and the number of buyers looking to make a purchase, home prices are on the rise. That means your home is worth more in today's market because it’s in high demand. Patrick Dodd, President and CEO of CoreLogic, explains : “Price growth is the key ingredient for the creation of home equity wealth. . . . This has led to the largest one-year gain in average home equity wealth for owners. . . .” Here's the answer to the $64,000 question. Because your home value has likely climbed so much, your equity has increased too. According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has grown by $64,000 over the last 12 months. While that’s the nationwide number, if you want to know what’s happening in your area, contact a member of The Carroll Group and we'll dig into the market stats for your home. The Opportunity Your Rising Home Equity Provides In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. When you sell your current house, the equity you built up comes back to you in the sale. In a market where homeowners are gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home. Or add a tidy sum to your bank account if you decide to downsize or move to an area with lower home prices. So, if you’ve been holding off on selling or you’re worried about being priced out of your next home because of today’s ongoing home price appreciation, rest assured your equity can help you achieve your moving goals. Contact us today for a complimentary market analysis and an in-depth discussion to see if it's time for you to make a move!

Read More -

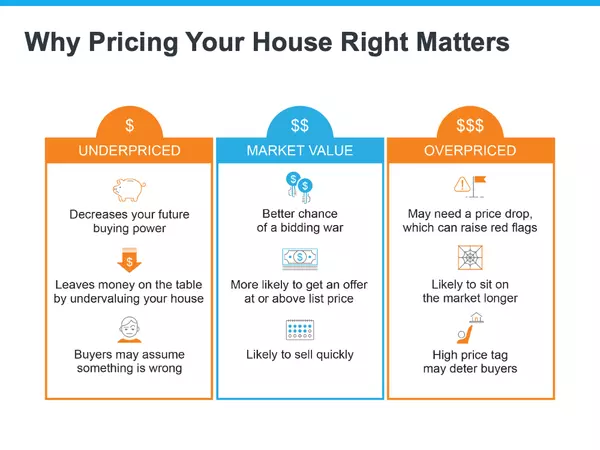

Are you ready to make a move and take advantage of today's sellers' market? With many homes continuing to get multiple offers, this could be the time to get the price and terms you’re looking for on your home sale. It's important to have an expert on your side to ensure you make all the right moves, especially when it comes to pricing your house. Even in thiscompetitive market, you can’t stick just any price tag on your home and get the deal you want. A key piece of the puzzle is setting the right asking price so buyers will notice your home (and get excited about it) from the very first time they view the listing. That’s where a real estate professional comes in. Why Pricing Your House Right Is Important The price you set for your house sends a message to potential buyers. Price it too low and you might raise questions about your home’s condition or lead buyers to assume something is wrong with the property. Not to mention, if you undervalue your house, you could leave money on the table which decreases your future buying power. On the other hand, if you price it too high you run the risk of deterring buyers. When that happens, you may have to do a price drop to try to re-ignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag for some buyers who will wonder why the price was reduced and what that means about the home. Think of pricing your home as a target. Your goal is to aim directly for the center – not too high, not too low, but right at market value. Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it. That makes it more likely you’ll see multiple offers, too. And if a bidding war happens, you’ll likely get an even higher final sale price. Plus, when homes are priced right, they tend to sell quickly and with better overall terms. There are several factors that go into pricing your house, and balancing them is the key. That’s why it’s important to lean on an expert Realtor to advise you when you’re ready to move, an expert who can easily and quickly determine The value of homes in your neighborhood The current demand for houses in today’s market The condition of your house and how it affects the value Daily changing market conditions Proper interpretation and implementation of these factors will make sure the price of your house makes the best first impression and gives you the greatest return on your investment in the end. Contact a member of The Carroll Group and let's get started on pricing and marketing your home in today's market!

Read More -

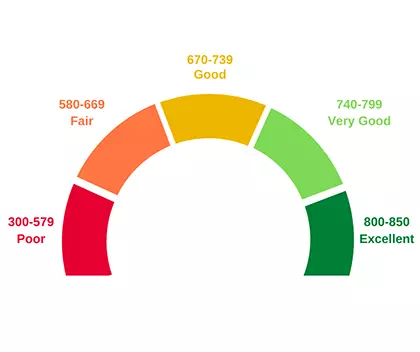

Do you have idea what your credit score is? It's good to keep an eye on it and know how to maximize it, especially if you're going to apply for a mortgage. Your credit score is one of the most important ways a lender determines your financial health and whether to extend credit to you. Here are 8 tips for improving your credit score. 01 Review your credit reports—get a free credit report yearly at annualcreditreport.com to know your credit score before applying for a loan. Also, verify that your report is accurate. If there are errors, dispute them with the credit bureau. 02 Pay down high balances—chipping away at bills may positively affect your credit score. 03 Keep track of your revolving account balances. 04 Pay your loans on time. 05 Keep balances low and try not to get near your credit limit. 06 Apply for credit only if you need it. 07 Keep old accounts open. 08 Request negative entries that have been paid off be removed from your credit report.

Read More -

Moving Day You’ve nailed down the day you close on your home. Now to start packing. But where do you start? Moving can be stressful, so let’s look at some tips for making it easier. Start with purging. Decluttering is a good way to start preparing for your move. If you don’t use an item there is no need to move it with you! Create three piles: a giveaway pile, a junk pile and a for sale pile. If you have the time and energy to sell some items, you just may wind up paying for part of your move with the profits. It will also feel good to give away items that you no longer need or love. Should you hire a company, rent a truck or rely on friends? Check into the options and see what you’ll really be charged, what you really need and what friends are willing to work for pizza or free babysitting! Friends can help you pack, carry and load boxes into a rental truck or your own vehicles. It’s good to keep a box or suitcase filled with items you will need right away. You don’t want to be left without a fresh set of clothing or your medications if your mover gets lost of delayed. You also may want to transport smaller fragile, treasured items yourself. Use a color-coding system when packing. For instance, all boxes with a green marking go in the kitchen, all boxes with a blue marking go in the bathroom, etc. It will make for much easier unpacking and a lot less frustrating searching! Rental trucks have some costs you may not anticipate or that may not be clear when you speak with someone at the company. You may need to pay for miles, insurance or extra hours in addition to gas. Having friends help load a rental truck with personal items or easy items to carry and transport can be a good time and money saving option. The less you have a professional moving company pack and carry, the less you will likely have to pay. Professional movers are not all the same. When getting a quote on a move with a professional moving company, be sure to get at least three quotes and compare them carefully. Not all quotes are created using the same criteria. Be sure to get everything clear and in writing before booking the move. It’s almost always best to have big and heavy items moved by the pros. They have appropriate packing and wrapping materials, and the packing methods and expertise to (hopefully) ensure your belongings arrive in good condition. Plus, you’ll be saving yourself and your friends from potential injuries resulting from heavy lifting! Certain times of the year can be busier than others, resulting in higher move costs and the need to plan a good deal in advance. You don’t want to be scrambling for a moving company when companies are short staffed due to holidays, weekends or the ever-popular first and last days of the month when everyone else wants to move!

Read More Update Your Bathroom in a Weekend

Are you looking for a quick and relatively inexpensive way to update your bathroom? It's pretty easy to do on your own. Here are some simple tips: Change the paint color. Paint your bathroom walls or vanity a fresh new color for an instant updated feel. Stick with neutral colors that won't "age" as quickly and that you can easily add pops of color to. Update your mirror. Get rid of that blah builder-grade mirror. That big piece of glass or the multiple-door mirror has zero appeal! Add a custom frame to match your personality, or opt for one of the beautiful oval or rectangular mirrors that mount on the wall with two arms to allow for perfect placement and angle. Modernize your hardware. Older hardware, from faucets to drawer pulls, can make a bathroom appear outdated. Swap it out for more current hardware, such as mixed metals - brass is hot now, as is chrome! Lighting. Are you still looking at that theater-style lighting with a row of lightbulbs highlighting your worst hair days? Ditch the light bar and add some fun new lighting, particularly something with LED lights to save on energy costs while updating. Accessorize. Sometimes it's as simple as replacing your linens and adding new accessories to the bathroom to give it a fresh, updated look. For more "pop" add a shelf and some minimal accessories like a candle, succulents or an air diffuser.

Read MoreAir Conditioning and Fans - How Much Do You Know?

It's that time of year when our thoughts turn to fans and air conditioning, and many homeowners have questions about which is best and how to use each most beneficially in the home. Here are some tips and general information about both fans and A/C. Whole-House Fan. Whole-house fan is a large ventiliating fan, typically mounted in a ceiling between living space and the attic. You'll generally see them in the ceiling of the hallway leading to the bedrooms. The fan draws warm air out of the living space and exhaustts it to the attic, where it goes out through the attic vents. To make the most effective ventilation, windows in the lower part of the house should be partially opened to bring cooler air into the home and create a flow through the house. Ceiling Fans. Ceiling fans can help make a home more comfortable, either alone or in combinatino with air conditioning. They increase air movement, making the air feel cooler. Contrary to popular belief, they do not actually cool the air, they just move it around, so there is no need to run them in rooms that are unoccupied or when you aren't home. EER and SEER Air Conditioner Ratings. Both EER (energy Efficiency Ratio) and SEER (Seasonal Energy Efficiency Ratio) are indicators of how efficient an air conditioner unit is; the higher the number, the more efficient it is and the lower the operating cost. SEER is used with central air systems, while EER is used with room air conditioners. While the current minimum requirement is 10.0 SEER, for new central air systems, SEERs of 12 or higher are generally considered high-efficiency units. For room units, EERs of 11 or higher are considered high-efficiency. The higher ratings will result in lower operating costs, especially if you use your central air conditioning a lot. Units with SEERs as high as 15 are now available. It is best to get a properly sized unit, whether a room unit or central air system. Although a larger unit may run for shorter periods of time, it will use more electricity due to its larger size. It may also fail to properly dehumidify your home. A properly sized unit will control both temperature and humidity, making the home more comfortable. Most Efficient Thermostat Setting. There is no specific setting that will work for everyone, in every home, in every state. Each degree you raise your thermostat can help you save up to 5% in cooling costs. Many professionals suggest setting the thermostat to 80 degrees when you are away, and set it to the highest comfortable setting when you are home.

Read MoreWhich Are Better: Decks or Patios?

Many people are drawn to one-floor homes because the accessibility they offer in terms of outdoor space is plenty. However, if you want outdoor space, you don’t necessarily have to move into a single-story home. If you move into a multistory home, yet there isn’t already a deck or a patio in place, you can usually add one. But which of the two should you choose? Here are a few things to keep in mind when trying to make your decision. Your yard When trying to decide between a patio and a deck, the answer may be as simple as looking at the layout of your yard. If you live on a slope or your yard contains hills, a deck would be easier to build than a patio. However, if your lawn is flat for the most part, a concrete, fieldstone or paver patio may be the way to go. Location of egress Another detail to factor into the equation is how you plan to access the deck or the patio. Do you have a door that opens directly into your yard, or is your first-floor access located above a walk-out basement? Building a deck or a patio that meets your form of egress is critical. Cost of construction You will also want to take a look at your budget. Complicated decks or stone patios can range in price, so you’ll always want to talk to a professional and get an estimate from someone who knows the industry. You may also need to determine the code requirements and obtain proper permits for your plans. Entertaining The last factor worth considering is how you plan to use your outdoor space. For example, do you want to have access to a fire pit? If so, you’ll likely prefer a patio over a deck. On the other hand, if you like to entertain guests, make sure you plan for an appropriate amount of seating space based on how many people you typically entertain. Are you looking to expand your outdoor space by creating an area where you can comfortably spend time outside? A deck or a patio might be the answer you’re looking for, though the better option of the two will depend on your preferences and overall vision. - courtesy of HomeActions, LLC

Read MoreHow PMI Can Help You Buy a Home

What is PMI? It is Private Mortgage Insurance, and it may be your savior when it comes to buying a home in this market. With home prices at the highest levels ever, and limited inventory to choose from, competition for affordable homes is fierce - especially with recent mortgage rate increases reducing purchasing power for many buyers. PMI works by lowering the traditional 20% down payment requirement for obtaining a mortgage. That 20% can be a hefty amount for anyone to save, nevermind with higher home prices. PMI allows for as little as 3% down, making it possible to buy a home far sooner. There are four significant ways PMI can help buyers: - Afford a Home Sooner. Waiting to save a 20% down paymnet can be a huge barrier, and as home prices continue to rise, the savings needed also increase. With PMI, you a buyer can purchase a home with as little as 3% down and begin to build equity and long-term wealth - Increase Your Budge. If a buyer is struggling to find the right home in the approved price range, PMI can help increase purchasing power by putting a lower percentage down on a more expensice home. For example, if a buyer is planning to put a 20% down payment on a $300,000 home, he may be able to use the savings from the down payment differential to purchase a $400,000 home. - Cover an Appraisal Gap. PMI can also work for buyers facing an appraisal gap (a property appraising for less than the contracted purchase price). PMI may be able to be used to shift the loan-to-value (LTV) and restructgure the loan so a buyer can cover an appraisal gap and still have enough money to meet the minimum down payment requirement. - Preserve Savings. Even if a buyer can afford a 20% down payment, a lower down payment with PMI may be preferred, as it provides an opportunity to set aside some cash as a cushion for unexpected economic times or repairs and maintenance items that may come up. Of special note is that most PMI products are temporary. Once the homeowner makes a certain number of payments or the property appreciates to a certain loan-to-value ratio and meets loan seasoning requirements, the insurance may be eligible for cancelation. When home prices go up rapidly, as they have in recent years, the payment can drop away even faster. Be sure to speak to your mortgage professional to discuss the pros and cons of PMI, and to get specific information on how PMI works.

Read MoreThings to Avoid After Applying for a Mortgage Loan

So, you're offer on your dream home has been accepted and you've applied for a mortgage loan. Before you get too excited and go shopping for new furniture and electronics, keep these things in mind. Otherwise, you could jeopardize not only your loan, but your chance at living happily ever after in that dream home! Here is a list of "don't do" items: - Don't make any large purchases. That new car may be calling your name, or that comfy sectional sofa and matching chair, but adding debt to your financial situation at this time will raise a red flag and could increase your debt-to-income ratio enough to disqualify you for a loan. - Don't open any new credit cards or apply for other types of credit! It doesn't matter if you will get triple points and can transfer your balance for free, you will impact your credit score by adding "potential debt" or "available credit" to your financial situation. - Don't deposit large sums of cash, another red flag to the mortgage company. Lenders need to be able to "source" your money, so if you have cash to deposit, be sure to provide the proper paper trail to account for its origin. - Don't switch banks. Don't be enticed by higher savings interest rates or free checking. At least not now. Again, lenders need to source and track your assets, and it's easier to do if there is consistency among your accounts. - Don't co-sign any loans for anyone! You might want to help your favorite aunt or your youngest child, but that adds a financial obligation to your credit situation. - Don't change jobs! Employment and income are huge components of your credit worthiness and your lender will re-check your employment status shortly before your closing. If you get a promotion and raise within your current company, of course, that's a great thing. If you want to look for a new job, wait until after you move into your new home. If there is a reason why you can't wait to change jobs, immediately speak with your lender to be sure things can be worked out. - Don't close any accounts. That sounds counterintuitive, but very important to your credit score are the length and depth of credit history, and your total use of credit as a precentage of available credit. So even if you pay all credit cards off monthly, or use only 1 or 2 cards out of your collection of cards, closing an account actually has a negative impact on your credit score. In the end, be sure to keep in contact with your lender throughout the mortgage application and approval process to ensure things go smoothly.

Read MoreSaving Money While Prices Are Rising

Are inflation's prices causing you concern over your budget? Here are some tips from Nerdwallet to help keep your budget in check - and in the black. - Reduce discretional, non-essential spending. If you're able to postpone weekend travel and skip a few drive-through meals and pricey coffees, you'll see a significant difference in the money you have left at the end of the month. Even a 5% savings can go a long way. - Cancel online subscriptions you aren't using on a regular basis. You may be surprised to see how many unwatched television channels, memberships, magazine and newspaper subscriptions and online games you're paying for but not using. - Renegotiate your monthly cable, streaming and cell phone bills. Even some apps will offer a discounted price if you attempt to cancel. Many companies are quite willing to cut you a break, you just have to ask. - Consider using public transportation or sharing rides to cut down on gas usage. You'll save money and the environment at the same time!

Read MoreSome Common Cooling Problems and How to Fix Them

Summer is here, finally! Will you be using your central air conditioning? If so, there are some common issues that crop up with the systems. Here are some tips to try before calling for service. - Not Powering On. Check to see if your a/c breaker has tripped or the fuse has blown. If so, turn the a/c to "off" and flip the breaker back to the on position or replace the fuse. Turn the a/c on again. If it still doesn't power on, it's time to call for service. System Does Not Produce Cool Air. The most common reason for this is a dirty, clogged air filter. The filter keeps debris from getting into the cooling system and from blowing dust into the air inside your home. Neglecting to clean the filter means the air won't be able to flow properly through the vents, freezing the evaporator and blocking the production of cool air. You can easily alleviate this problem by cleaning the filter. If your system has a removable filter, just remove it and blow the dust out of the filter. If you have a waterproof filter, you can wash it and then replace it when it is clean and dry. If your filter is not removable, call a service technician to take care of cleaning or replacing the filter. - Thermostat Not Working Correctly. There's nothing worse than turning your a/c to a cooler setting and not getting cooler air! Double check to be sure you have set the thermostat to the desired temperature. If so, then try setting it to auto mode. If that doesn't work, it's time to call for service. - Leaking. The a/c may drip because of an overflowing or cracked drip pan. It's easy enough to replace a cracked pan or tilt it to allow condensate to flow out. It could also be a clogged condensate drain line. You can clear the line by using a stiff wire bruch inserted into the line, or try sucking out algae and leaves with a wet/shop vac. If you suspect the unit is leaking refrigerant, you'll need to call for professional help. - The Bottom Line. Regular maintenance is key. Whether you do it yourself or hire a professional, be sure to perform annual maintenance.

Read More

Categories

Recent Posts